Here’s a question nobody asks.

Putting aside for a moment the question of the strategic effectiveness of sanctions, who gets to hold, keep, profit from, or distribute the trillions of dollars in seized assets?

Follow the money. It’s an old cliche. But following the money is not always easy. You can’t just look it up on Google.

Yesterday, the U.S. and NATO allies announced they would block Russia’s access to its foreign currency reserves in the West, about $640 billion, essentially freezing its assets. They will also bar certain Russian banks from SWIFT, which severely limits their access to the international financial system and prevents Russia from receiving payment from countries like the US who continue to buy oil and gas from them. It is expected that these measures will wreak havoc on Russia’s economy, not to mention our own and Europe’s.

Economic sanctions provide the west with a policy tool short of military force for punishing or forestalling actions by governments they find objectionable. As the world's largest economy and largest trade bloc, the U.S. and the European Union have disproportionate sanctions powers at their disposal.

But the threat of current sanctions was never expected to dissuade Putin from invading Ukraine. Rather they’re meant as punishment for him and the Russian people. The hope in the west is that if enough pain is inflicted on the ordinary Russians, they will rise up against Putin and the oligarchs. But this is a plan that could easily backfire. Some warn that the current wave of sanctions could once again collapse the entire global financial system.

But, putting aside for a moment the question of the strategic effectiveness of sanctions, my question is, who gets to hold, keep, profit from, or distribute the trillions of dollars in assets seized over the years from countries like Nicaragua, Iran, China, Afghanistan, and now from Russia? I imagine it is one of the largest single concentrations of capital in the world, almost equaling the size of the Pentagon’s annual budget.

I’m asking specifically about assets that can be seized or frozen, preventing their sale or withdrawal.

The answer I’m told is that it’s the Office of Foreign Assets Control (OFAC) of the US Department of the Treasury that administers and enforces economic and trade sanctions…

“…based on US foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and other threats to the national security, foreign policy or economy of the United States.”

But that bureaucratic answer doesn’t really get at it. For example, how were funds seized from Nicaragua back in the ‘80s used by the CIA to illicitly fund the contras?

Sanctions from the U.S. are particularly forceful because many transactions run through New York City. The dollar also remains the world’s reserve currency and is used in payments across the globe. Whenever money from sanctioned people or entities flows through the U.S., which is common, those assets are immediately frozen.

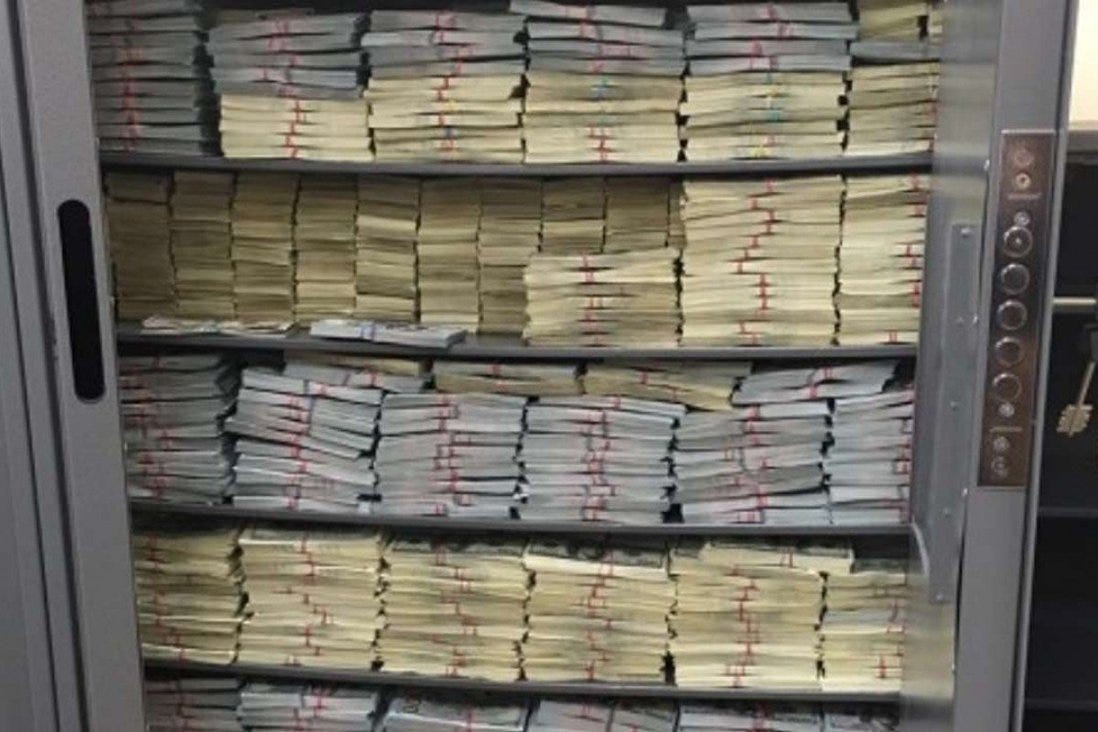

But who really decides what happens to those assets once they are seized? Surely, those dollars, Euros, Rubles, etc… don’t just sit in a room somewhere waiting for some unnamed Treasury Dept. ‘crat to decide how and if they’re spent. And what about European bankers? Do they get to use it for investment? Profit from it? Will they ever give it back once a deal to end the fighting is reached? Is there any public accounting?

While aid groups estimate that nearly 24 million Afghan people, more than half the country, face severe hunger and nearly 9 million are on the brink of starvation, the world’s wealthiest country, the one that invaded and occupied that country for decades, denies it the money needed to rebuild its war-torn economy. Who decided that and how? The same for the assets seized from Russia. Will it be used to help the people of Ukraine, nearly half of whom were living in poverty even before the Russian invasion?

So if any readers have answers to these and related questions, help me out here, please. Use the comment section below.

Thanks Jef, but what does "absorbed" mean?

I’d guess assets are held for due process, until formally awarded to the USG, then turned over to Treasury and absorbed. Non-liquid assets are auctioned then processed. Just guessing (as an ex fed).